Introduction

Smart Lock Integration with Home Insurance: The New Money-Saving Trend

Implementing smart locks offers numerous benefits, such as:

- Enhanced security: Advanced features deter potential intruders.

- Convenience: Remote access allows you to control entry points effortlessly.

The intersection of smart locks and home insurance is more than just a technological advancement. It presents a potential money-saving opportunity that attracts both cost-conscious consumers and tech enthusiasts. As homeowners increasingly seek ways to protect their properties while managing expenses, integrating smart locks into home security systems stands out.

Insurance providers recognize the value of these devices in reducing risks associated with theft and damage. By installing smart locks, you not only elevate your home’s security profile but may also unlock significant savings on your insurance premiums. This trend is reshaping how homeowners approach safety and financial planning.

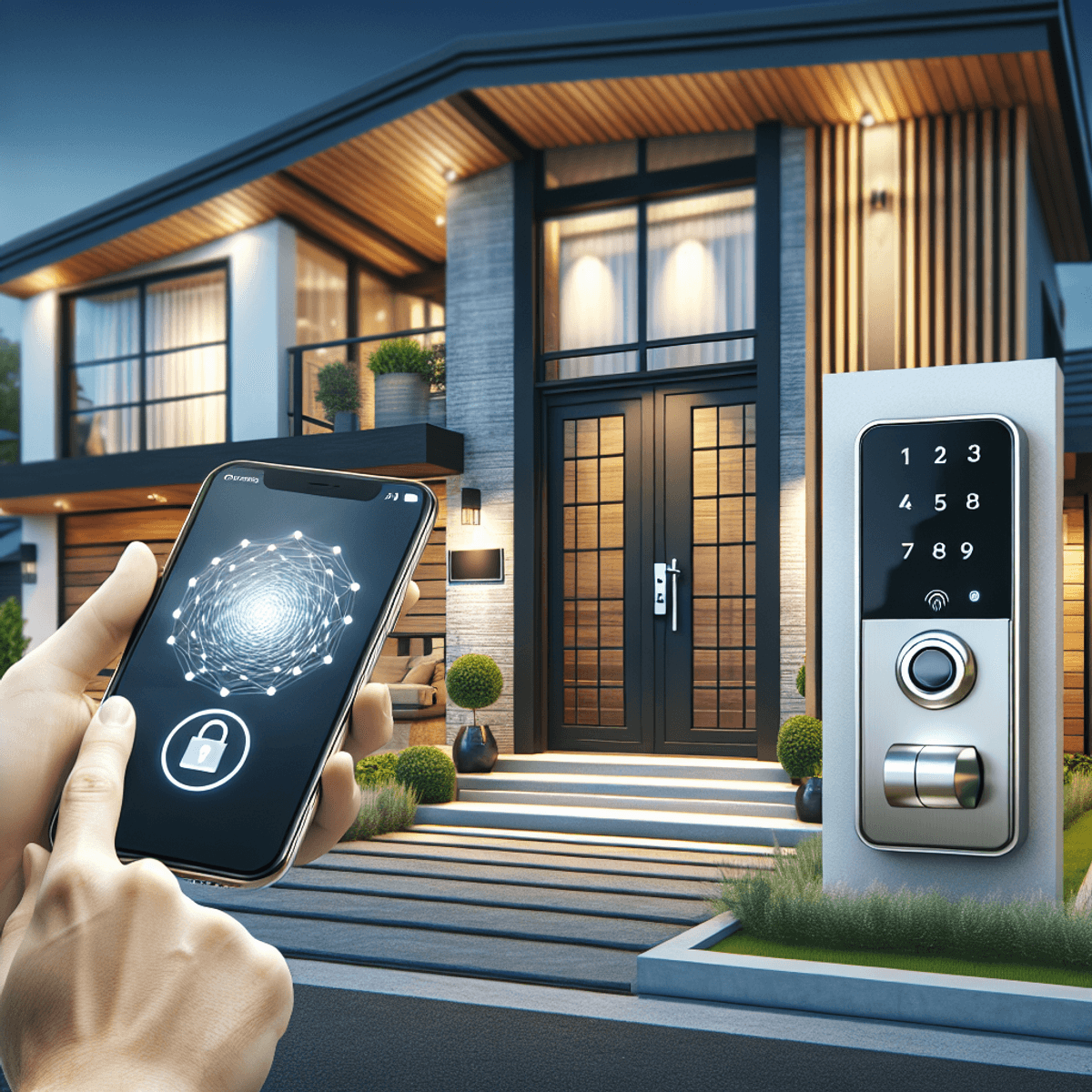

The Rise of Smart Locks in Home Security

Smart locks are an important development in home security. They use wireless technology to improve safety and make things more convenient. Essentially, smart locks are locking devices that let homeowners control access from a distance.

Key Features of Smart Locks

Some of the main features that set smart locks apart include:

- Keypads for easy code entry

- Biometric access such as fingerprint recognition

- Integration with smartphone apps for remote locking and unlocking

Advantages of Smart Locks over Traditional Systems

When we compare smart locks to traditional locks, there are several clear benefits. Here are some reasons why smart locks stand out:

- Remote access capabilities: With smart locks, you can manage entry into your home from anywhere using your smartphone or other connected devices.

- Seamless integration with other smart home devices: Smart locks can work in harmony with other security features like cameras and alarms, creating a comprehensive system that offers greater protection.

This interconnectedness is crucial because it establishes a complete security ecosystem, making your home more resilient against potential threats.

The Growing Popularity of Smart Home Technology

The increasing popularity of smart home technology is driving the rise of smart locks. As more people embrace these innovations, the demand for advanced security solutions continues to grow.

Homeowners are increasingly prioritizing safety through technological enhancements, leading to a shift away from conventional locking methods. As this trend evolves, smart locks are becoming an essential component of modern home security strategies.

Home Insurance Discounts for Smart Lock Owners

Installing smart locks can significantly impact your home insurance premiums. Many insurance providers offer premium discounts ranging from 5% to 20% for homeowners who incorporate these advanced security measures.

Key Factors Influencing Eligibility

- Type of Smart Lock: The specific model of smart lock you choose plays a crucial role. Locks with features such as keypads, biometric access, and remote control capabilities are often favored by insurers.

- Comprehensive Security System: Integrating smart locks into a broader security setup is essential. Standalone smart locks may not always qualify for discounts unless they are part of a comprehensive system that includes additional devices like cameras or motion sensors.

Insurers may also require smart lock certification to confirm that the device meets certain security standards. This certification assures them of its effectiveness in reducing risks associated with theft and damage.

By understanding these factors, you can strategically select smart locks that not only enhance your home security but also maximize potential insurance savings.

Understanding Risk Assessment in Relation to Smart Lock Integration

Insurance providers prioritize risk reduction when evaluating homes equipped with smart locks. These devices significantly enhance a property's security profile, leading to more favorable assessments regarding theft and damage. Key factors influencing this risk assessment include:

- Enhanced Security Features: Smart locks offer advanced functionalities like keypads and biometric access, making unauthorized entry more difficult.

- Integration with Security Systems: When smart locks are part of a comprehensive security system, insurers recognize the added layers of protection, which can lower perceived risks.

Insurers establish specific policy requirements reflecting these advancements in technology. Homeowners may need to meet particular installation standards or compliance criteria to qualify for discounts. This could involve:

- Installing smart locks recognized by insurers

- Ensuring compatibility with other smart home devices

Understanding these elements is crucial for homeowners considering smart lock integration. Being proactive about meeting insurance providers' standards not only helps in securing discounts but also enhances the overall safety of the home. By prioritizing both security enhancements and compliance with policy requirements, homeowners can effectively navigate the landscape of insurance benefits tied to smart technology.

Evaluating the Cost-Benefit Ratio of Smart Lock Installation for Homeowners

Installing smart locks involves initial costs, typically ranging from $100 to $300 per unit, including professional installation fees if needed. However, these expenses can lead to significant long-term savings through reduced home insurance premiums.

Potential Savings and Additional Benefits

- Potential Savings: Homeowners may see discounts between 5% and 20% on their insurance premiums after installing smart locks. Over time, these savings can offset the initial investment.

- Additional Benefits: Beyond financial incentives, smart locks offer enhanced convenience. You can lock or unlock your doors remotely, monitor access in real-time, and eliminate the need for physical keys. These features contribute to peace of mind, knowing your home is secure.

Real-Life Scenarios

Consider a homeowner who installed a smart lock and integrated it into a comprehensive security system. After installation, they received a 15% discount on their insurance premium. The upfront cost was recouped within two years through premium savings alone.

Such examples illustrate how adopting cost-effective solutions like smart locks not only improves security but also provides long-term savings that justify the initial investment. Performing a thorough cost-benefit analysis can reveal substantial advantages for tech-savvy homeowners looking to enhance their security while managing costs effectively.

Conclusion

The combination of smart lock integration with home insurance is making home security more accessible and affordable. Here are some key points to consider:

- Enhanced Security: Smart locks provide advanced safety features that greatly reduce the risk of theft.

- Potential Savings: Insurance companies are increasingly offering discounts ranging from 5% to 20% for homes equipped with smart technology.

- Convenience and Peace of Mind: Remote access and monitoring capabilities allow homeowners to manage their security effortlessly.

As you look into future trends in home security, investing in smart locks not only improves your property's safety but also opens up opportunities for significant savings on insurance premiums. Embracing this new cost-saving trend allows you to benefit from advanced technologies while protecting your investment. Take action today and think about how integrating smart locks can enhance your home security strategy and financial well-being.

FAQs (Frequently Asked Questions)

What are the benefits of implementing smart locks?

Implementing smart locks offers enhanced security and convenience, allowing homeowners to control access remotely and integrate with other smart home devices.

How can installing smart locks affect my home insurance premiums?

Installing smart locks can lead to premium discounts from insurance providers, typically ranging from 5% to 20%, depending on the type of smart lock and whether it is part of a comprehensive security system.

What factors influence eligibility for insurance discounts related to smart locks?

Eligibility for insurance discounts can be influenced by the type of smart lock installed, its certification, and whether it is integrated into a broader security system.

How do insurance providers assess risks associated with homes equipped with smart locks?

Insurance providers assess risks by evaluating how smart locks enhance a property's security profile, which can reduce the likelihood of theft and damage.

What is the cost-benefit analysis of installing smart locks for homeowners?

Homeowners should consider the initial costs of purchasing and installing smart locks against potential long-term savings on insurance premiums, along with additional benefits like increased convenience and peace of mind.

What future trends should I expect in home security regarding smart locks and insurance discounts?

Future trends will likely see an increased integration of modern technologies like smart locks with home insurance policies, creating more opportunities for cost savings while enhancing overall home security.

Comments

Post a Comment